Why Women

Traditional financial planning is built on a masculine approach. But in a world where women live longer, earn less and take more time off to care for others – we think it’s time for women to take charge of their money in a way that addresses their unique needs.

We specialize in helping women overcome these challenges by providing planning that encompasses every aspect of a woman’s life: financial, physical and emotional. Our holistic approach recognizes that financial health works in tandem with physical health and emotional health to create a purpose-driven retirement.

We employ a woman’s touch to communicate in the language of protection and security versus risk and reward. Above all, we understand women’s unique needs, helping you build wealth and create the financially secure future you deserve.

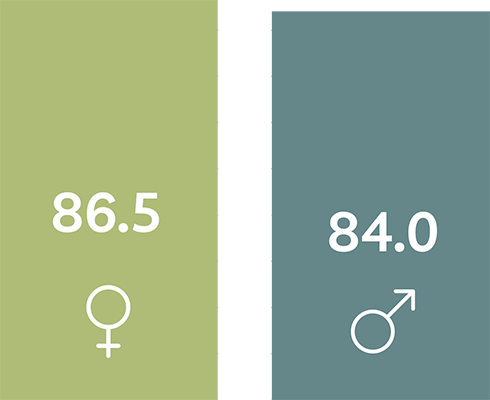

Women Live Longer

On average, women outlive men by 2.5 years. This increases the amount they need for basic living expenses and health care costs. They also have a higher potential need for long-term care.

On average, 1 out of 3 individuals – both men and women – will live to age 90. And 1 out of 7 will live to age 95.

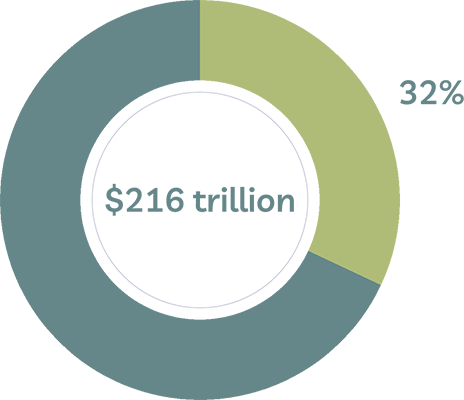

Women Control More Wealth

Women are pursuing higher education and attaining senior job titles in record numbers. Many women in their 50s and 60s are also on the receiving end of the largest intergenerational wealth transfer in history.

As a result, by 2019 women controlled $216 trillion in wealth – and that number is estimated to grow to $271 trillion by 2023.

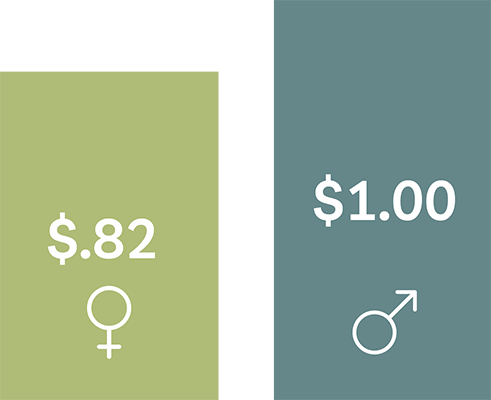

Average amount women earn

for every $1 made by men:3

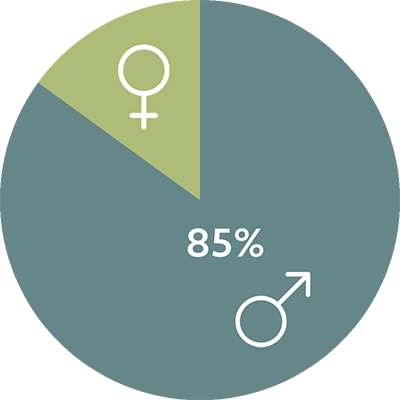

Women Earn Less

We may be moving on up – but we’ve still got a long way to go. On average, women still earn only 82¢ for every dollar a man earns.

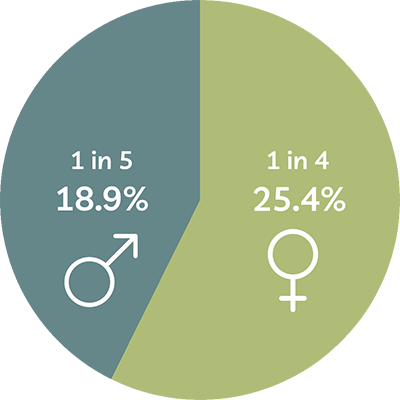

Women Take More Time Away From Their Careers

Throughout our careers, we’re more likely to take time off to care for someone we love – a child, grandchild, elderly parent or ailing spouse. Less time out of the workforce leads to reduced lifetime earnings, retirement savings, and future Social Security benefits.

Women Measure Financial Success Differently

While our male counterparts gravitate toward returns-oriented financial planning, women tend to want financial planning that focuses on security for the future and making sure everyone is provided for. Our female advisors understand that wealth building isn’t just about numbers – it’s about people.